43 perpetual zero coupon bond

Mueslify - Zero Coupon Perpetual Crypto Bond Muesli Venture Capital Issues Zero Coupon Perpetual Crypto Bond For immediate release 16.8.2019 Muesli Venture Capital has offered Zero Coupon Perpetual Crypto Bonds to the public with fixed interest rate of 0%. The size of the bond issue is USD 10 billion. The proceeds from the issue will be Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the...

What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 848 views View upvotes

Perpetual zero coupon bond

Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street... Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice. US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

Perpetual zero coupon bond. finra-markets.morningstar.com › BondCenterBonds - Quick Search - Morningstar, Inc. 1 day ago · 144A Bond Include Exclude; Coupon and Interest; ... Perpetual Bonds Include Exclude; ... 144A Bond Type. Coupon Type. Coupon ... 42 perpetual zero coupon bond The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. › terms › pPerpetual Bond Definition Mar 19, 2020 · The discount rate denominator reduces the real value of the nominally fixed coupon amounts over time ... en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon. Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings

› gstripsInvest in G-SEC STRIPS India - Bondsindia.com The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond? 43 perpetual zero coupon bond Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). Greek debt "transformed into a zero-coupon perpetual bond" Credit Suisse: - Following the buyback, more than 80% of Greece's debt will be held by the official sector and seems to be in the process of being - for all practical purposes - transformed into a "zero-coupon perpetual bond".The average maturity on the EU/EFSF loans (which will soon represent 65% of Greek debt) is increased to 30 years, while there is a ten-year grace period. › bondsSecondary Bonds Market – Types of BondsIndia You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds.

Perpetual bond - Wikipedia A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, [1] therefore allowing it to be treated as equity, not as debt. Issuers pay coupons on perpetual bonds forever, and they do not have to redeem the principal. Perpetual bond cash flows are, therefore, those of a perpetuity . Contents Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity. › terms › pPerpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Is fiat currency the same as a perpetual zero coupon bond? Answer (1 of 4): representative money, like gold standard money, can be considered a debt in that the hold is owed that amount of gold and a bond is something one is paid an increased value on over time if with the gold standard there is still inflation, which there usually was, then as the val...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD ... International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD USG6712EAB41 Download Copy to clipboard Perpetual, Guaranteed, Trace-eligible, Zero-coupon bonds, Senior Unsecured Status Early redeemed Amount 1,758,820,530 USD Placement *** Early redemption *** (-) ACI on No data Country of risk Brazil Current coupon - Price - Yield / Duration -

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

Domestic bonds: DOF Subsea, 0% perp., USD NO0010955867 Issue Information Domestic bonds DOF Subsea, 0% perp., USD. Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings

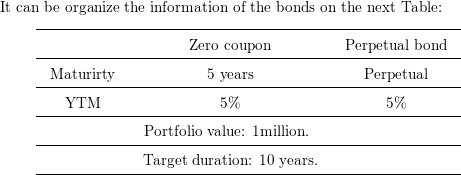

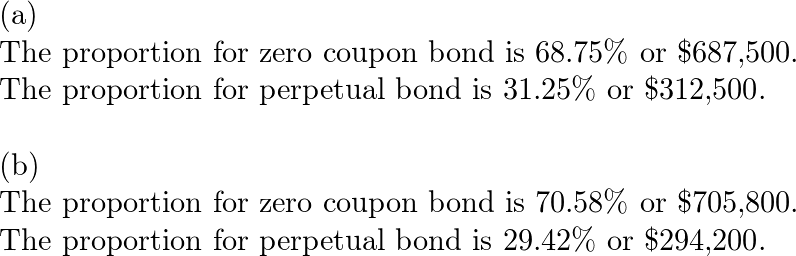

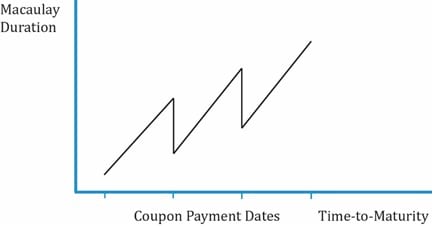

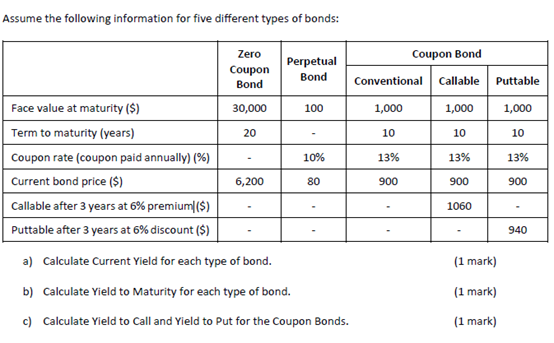

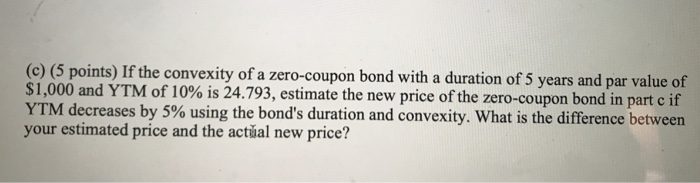

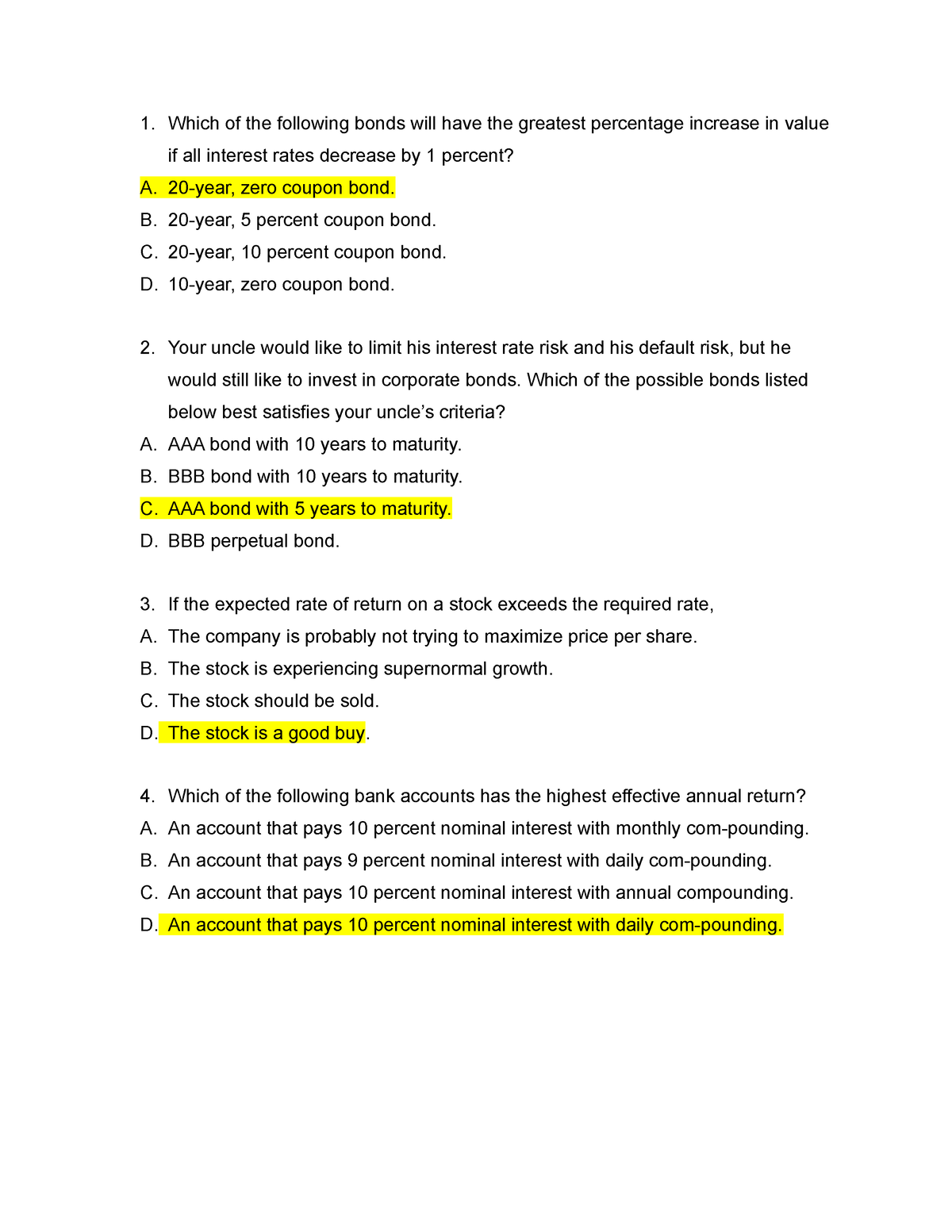

2022 CFA Level I Exam: CFA Study Preparation The Macaulay duration of a zero-coupon bond is its time-to-maturity. The Macaulay duration of a perpetual bond (perpetuity) is (1 + r) / r. Coupon rate is inversely related to Macaulay duration and modified duration. ... The exception is long-term, low coupon bonds, on which it is possible to have a lower duration than on an otherwise ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation.

Impossible Finance — The Zero Coupon Perpetual Bond - Medium The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero...

Perpetual Bonds - Define, Advantages, Disadvantages, Calculate, Duration The literal meaning of perpetual is never-ending o Perpetual Bonds - Define, Advantages, Disadvantages, Calculate, Duration Perpetual bonds are irredeemable fixed-income bonds having no maturity.

› investing › how-to-investHow to Invest in Bonds - The Motley Fool Sep 18, 2022 · For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town will promise to pay you interest on that $10,000 every six months and then return your $10,000 after ...

What is the purpose of a Zero Coupon Bond? To make a zero coupon bond pay, it is sold at a discount to face value. For instance, if the bond is worth $1,000 at maturity, it might be sold at $970. Then the buyer gets a gain of $30 (a little over 3% on $970) when the bond matures. Treasury bills are sold as zero coupon "bonds."

Bernanke Floated Japan Perpetual Debt Idea to Abe Aide Honda Ben S. Bernanke, who met Japanese leaders in Tokyo this week, had floated the idea of perpetual bonds during earlier discussions in Washington with one of Prime Minister Shinzo Abe's key advisers.

42 perpetual zero coupon bond Bitcoin and M1 Inflation - by Stephen Perrenod - Substack Thirty year Zeros are slightly lower than that, and the Treasury long bond with a ...

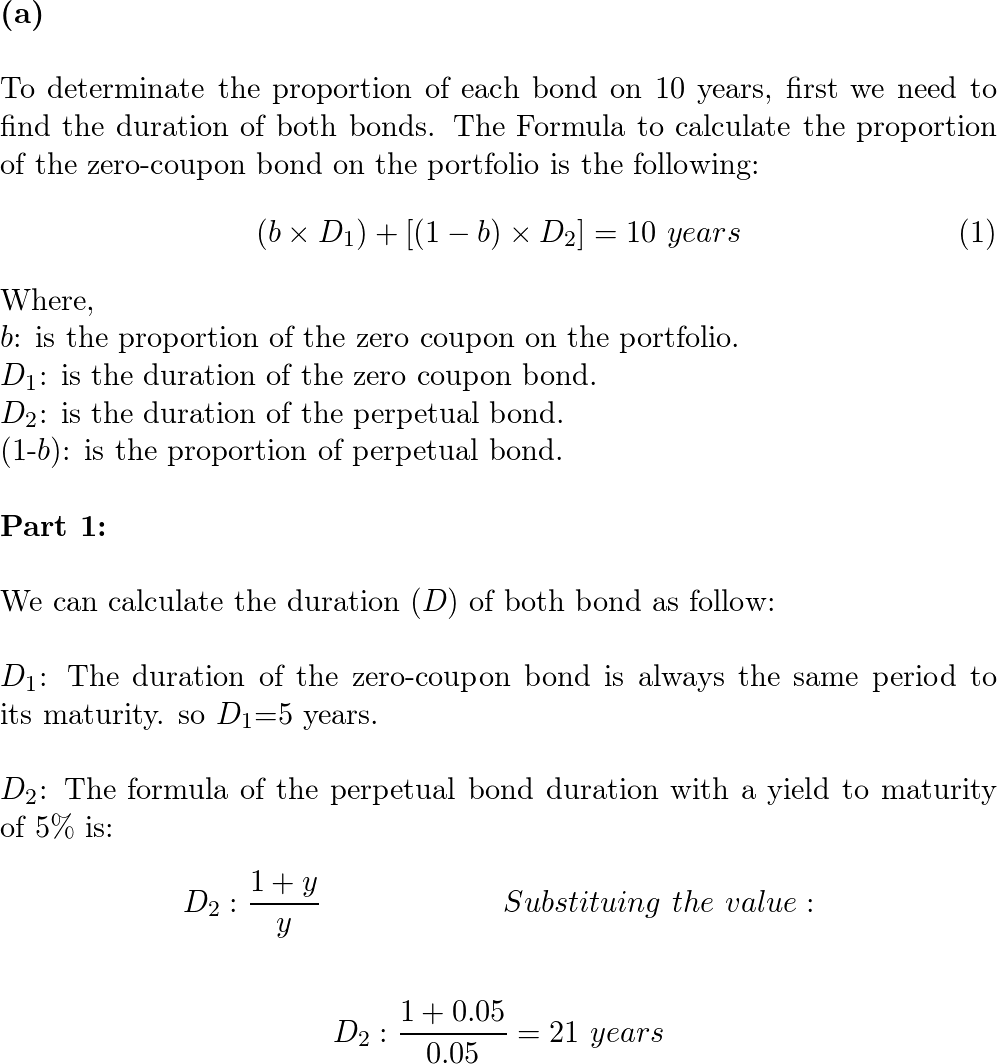

Perpetual Bond and Zero Coupon Bond - brainmass.com The formula for the duration of a perpetual bond that makes an equal payment each year in perpetuity is (1+yield)/yield. If bonds yield 5%, which has the longer duration--a perpetual bond or a 15 year zero coupon bond? What if.

perpetual zero bond - Αγγλικά-Γερμανικά μετάφραση | PONS Βρείτε εδώ την Αγγλικά-Γερμανικά μετάφραση για perpetual zero bond στο PONS διαδικτυακό λεξικό! Δωρεάν προπονητής λεξιλογίου, πίνακες κλίσης ρημάτων, εκφώνηση λημμάτων.

US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street...

Post a Comment for "43 perpetual zero coupon bond"